Economic Substance in Estonia: what it means, why it matters, and how to prove it

“Economic substance in Estonia” is not a single legal test you can tick off once and forget. In practice, it’s the overall evidence that your Estonian company is a real, functioning business with genuine decision-making, commercial rationale, and operational capacity – not just a registration used to access EU credibility, tax outcomes, or banking.

For international founders, substance comes up most often in three places:

– banking and payment providers,

– tax authority questions in Estonia or abroad,

– cross-border structures

where treaty benefits, withholding taxes, or “conduit” concerns may apply. Estonia is very digital, but “digital” does not mean “substance-free”.

Within the first steps of setting up, it helps to work with a local partner that can align your structure, accounting, and ongoing compliance from day one – for example, Silva Hunt, our Estonia-based accountancy and tax advisory firm. Look our Business Setup services.

What “economic substance” typically means in Estonia and why there isn’t one magic rule

Economic substance is usually assessed as a fact pattern: who makes decisions, where key functions happen, whether the company can actually perform what it claims to do, and whether it has the people/resources to bear commercial risk.

Importantly, Estonia’s corporate tax residency rule is straightforward: an entity is considered Estonian tax resident if it is established under Estonian law (there isn’t a separate “management and control” test for determining Estonian corporate residence).

That simplicity helps, but it doesn’t eliminate substance risk – because other countries may apply “place of effective management” concepts for their tax residency rules, or treat your activity as creating a permanent establishment (PE) abroad. Estonia’s own materials for e-residents also stress that cross-border tax outcomes depend on where activity happens.

Why economic substance in Estonia matters to founders running remotely

Even when your company is properly incorporated and compliant in Estonia, weak substance can cause real operational friction:

- Banking and EMI onboarding: providers commonly ask for proof of business activity, contracts, counterparties, and where management operates.

- Cross-border tax scrutiny: another jurisdiction may argue that the company is effectively managed there, or that local activity creates a PE (with local tax and reporting consequences).

- Treaty/withholding tax outcomes: in wider EU practice, “beneficial owner” and “conduit” questions often overlap with substance (especially for royalties, interest, and holding structures).

- Anti-abuse rules: Estonia has a general anti-abuse framework that can deny tax outcomes for arrangements primarily aimed at obtaining a tax advantage.

Substance is less about “having an office in Tallinn” and more about being able to show that the company’s decisions and activities match its commercial story.

Economic substance in Estonia vs. “substance where you operate”: the key distinction

A common misconception is that you must “move everything” to Estonia to have economic substance in Estonia. In reality:

- If your company sells digitally and you manage it while traveling, substance is about coherent evidence: governance, contracts, invoices, bookkeeping, and clear operational processes.

- If you are consistently operating from a specific country (signing contracts there, managing a local team there, negotiating there), then substance may be building there – and that may be completely fine, as long as you handle local tax and PE risk properly.

For many founders, the goal is not “maximum Estonia presence”, but “no mismatches”: what you do, where you do it, and how you document it should line up.

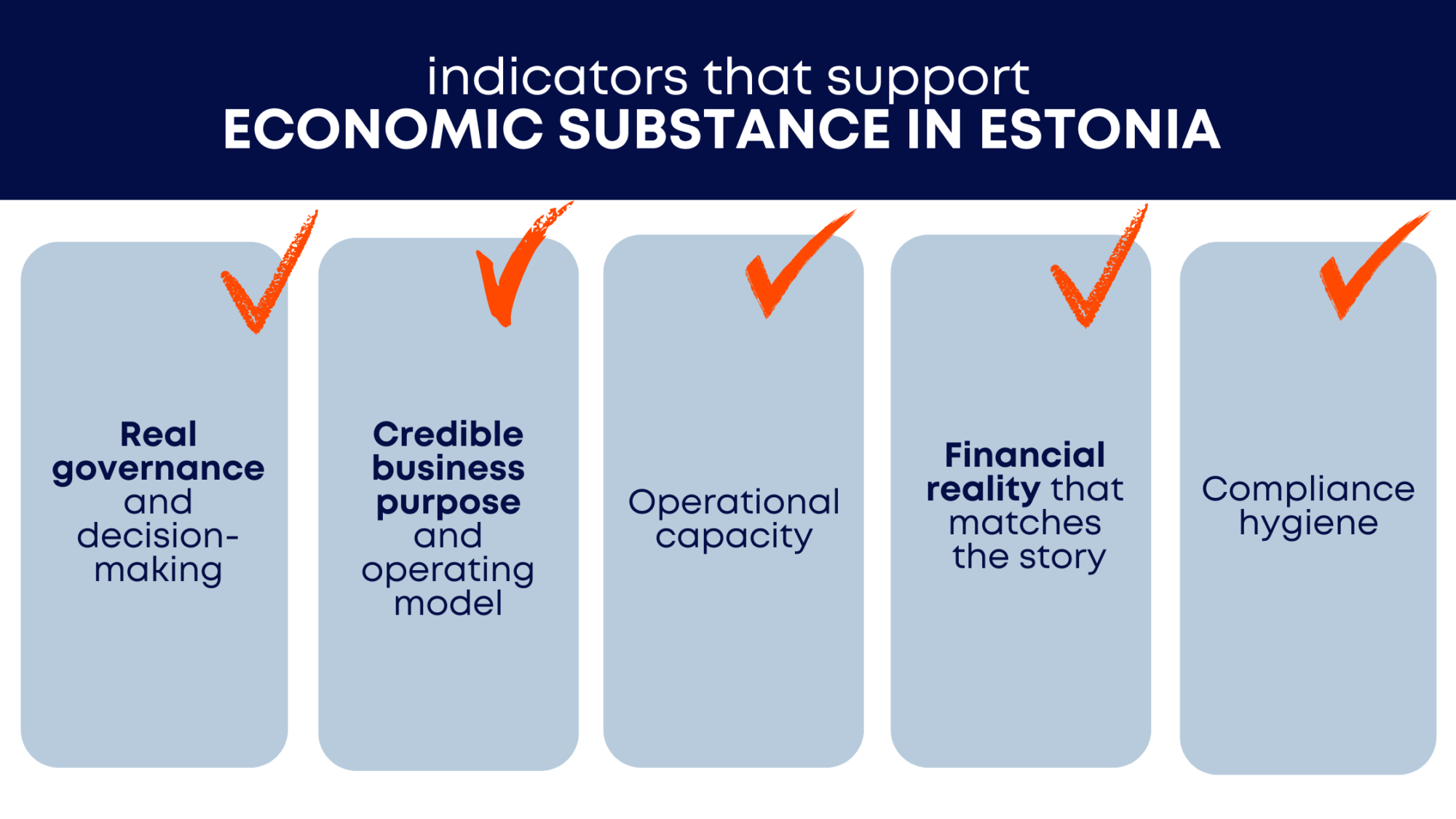

Practical indicators that support economic substance in Estonia

There’s no universal checklist that fits every company, but these are common “substance-positive” signals when someone reviews your structure (bank, auditor, tax authority, counterparty):

1) Real governance and decision-making

- Board resolutions for key decisions (contracts, financing, dividend decisions, major suppliers)

- Clear roles: who is director/management, who has signing authority, and why

- Evidence that decisions are actually made through the company’s governance (not informally in someone’s personal email)

2) A credible business purpose and operating model

- A plain-English explanation of what the company does and why Estonia is a sensible base (EU market access, digital administration, investor familiarity, etc.)

- A documented operating model: sales flow, delivery process, customer support, suppliers

3) Operational capacity

- Service agreements (e.g., accounting, legal, virtual office where appropriate)

- Tools and systems used by the company (billing, CRM, project management, support)

- If relevant: employees/contractors and written contracts

4) Financial reality that matches the story

- Invoices, bank statements, and bookkeeping that show genuine trading

- Contracts that reflect how value is created (especially for IP, consulting, or intercompany services)

5) Compliance hygiene

- Timely accounting, annual report filing, VAT reporting (when applicable)

- Proper payroll and board remuneration handling when relevant

If you can show these consistently, “economic substance in Estonia” becomes much easier to defend in real-world reviews.

How to document economic substance in Estonia without overcomplicating it

Most substance problems are not caused by bad intentions – they happen because founders don’t keep evidence in a structured way. A simple approach:

- Maintain a monthly “substance folder” (cloud drive) with:

- key contracts signed that month

- invoices issued and major bills

- a short board note/resolution covering major decisions

- proof of delivery (project milestones, support logs, shipment evidence, etc.)

- Keep your company narrative consistent:

- website + pitch deck + invoices should match what the company claims to do

- If the company is part of a cross-border structure:

- keep memos showing why the structure exists commercially (not only tax-driven)

- ensure intercompany agreements are real and followed in practice

Where anti-abuse rules apply, authorities typically look at the overall facts and whether arrangements are artificial or primarily aimed at tax advantage.

Common mistakes that weaken economic substance in Estonia

These are patterns that regularly trigger questions:

- Nominee-like governance: the director exists on paper but doesn’t understand or control the company.

- No contracts, only transfers: money moves, but there’s no documentary backbone.

- Mismatch between value and activity: e.g., large “management fees” with no evidence of services.

- “Estonia-only for tax” messaging: even if you never say it out loud, your structure may look like it if there’s no credible business reason or operational logic behind it.

Also remember: Estonia may treat your company as resident because it is incorporated in Estonia, but that doesn’t prevent another country from asserting taxation rights if activity creates a PE or similar nexus.

Economic substance in Estonia for holding, IP, and investment structures

Substance becomes more sensitive when the company’s main purpose is passive (holding shares, owning IP, lending, receiving royalties/interest), because these structures often interact with withholding taxes and “beneficial owner” concepts. Estonia’s cross-border context and EU practice show that beneficial ownership and substance are recurring themes in withholding tax and treaty situations.

If your Estonian entity is a holding or IP company, substance typically needs to be stronger on:

- governance (investment decisions documented)

- risk control (why the company bears risk)

- capability (who manages assets/IP and how)

What to do if you’re remote: a realistic substance plan

You don’t need to “pretend to be local”. You need consistency.

A practical plan many founders use:

- Keep Estonian compliance perfect (accounting, annual report, tax filings).

- Document governance properly (board decisions, signing authority, contract approvals).

- Ensure operational evidence exists (customers, delivery, systems, contractors).

- If your real operations are in another country, treat that seriously (PE and local compliance assessment).

That’s how you build economic substance in Estonia in a way that holds up not only in Estonia, but also when other jurisdictions or financial institutions look at the same facts.

Silva Hunt can help you build real substance from the ground up and support you at every step. We start by assessing what your business actually needs to demonstrate substance in Estonia, then set up the right structure and compliance framework to match your operations. When practical support is required, we can also connect you with trusted local providers—such as virtual office solutions, legal partners, payroll support, and other service companies—so you can cover the key requirements and document your substance correctly from day one.

Schedule a call

Schedule a call

Send a message

Send a message