5 Key Questions About Estonia Company Incorporation

Starting a company in another country often raises more questions than answers – especially when the process is described as “digital” or “remote.” Estonia company incorporation is frequently mentioned as a solution for international entrepreneurs, but the reality is more nuanced than the headlines suggest. Understanding how the system actually works is essential before making any structural decisions.

This article addresses the most common and practical questions founders ask when considering Estonia as their business base. Rather than focusing on promises or shortcuts, it explains what Estonia company incorporation does, what it requires, and where entrepreneurs need to be especially careful – so you can assess whether it fits your situation with clarity and realistic expectations.

Is Estonia company incorporation a legal way to run an EU business remotely?

Short answer: Yes. But only if it’s done correctly.

Estonia company incorporation is a legal process governed by Estonian and EU law. When you register a company in Estonia, you create a real legal entity that must comply with corporate, tax, and reporting obligations.

What makes Estonia different is how these obligations are handled. Most administrative actions can be completed digitally, which allows founders to manage their companies remotely without being physically present in Estonia.

This makes Estonia attractive for international founders, but it does not remove legal responsibility.

What kind of businesses usually choose Estonia company incorporation?

Estonia company incorporation is typically chosen by businesses that are international by nature, rather than local.

Common examples include:

- Service-based companies working with foreign clients

- Digital products and SaaS businesses

- Holding or IP-owning companies

- Solo founders operating across borders

It is less suitable for businesses that depend on local walk-in customers, warehouses, or regulated on-site activities.

A useful rule of thumb: if your business can operate without a fixed physical location, Estonia is often a workable option.

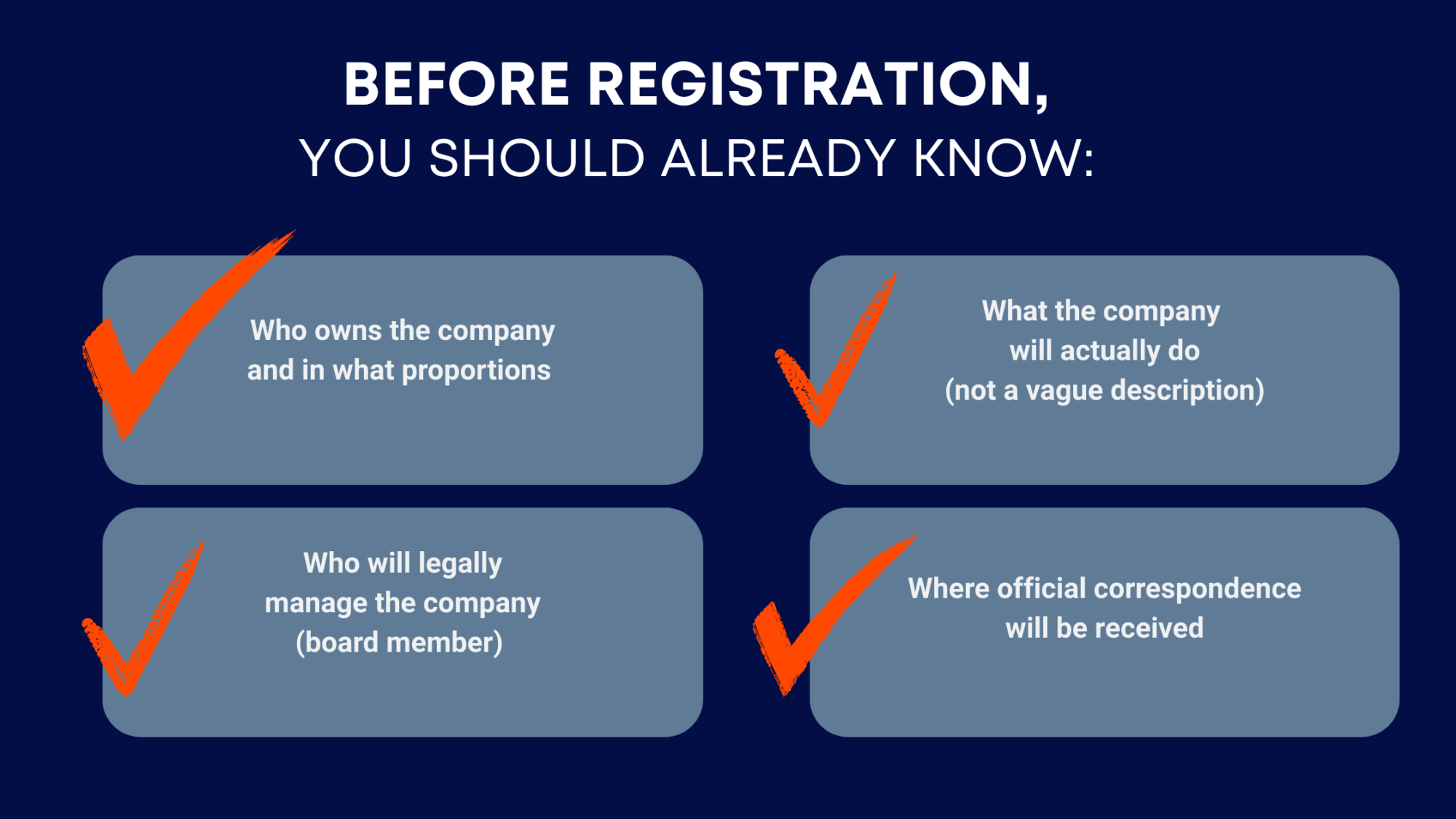

What information must be decided before starting Estonia company incorporation?

One reason founders struggle with Estonia company incorporation is that they start too early, without clear decisions.

Before registration, you should already know:

- Who owns the company and in what proportions

- Who will legally manage the company (board member)

- What the company will actually do (not a vague description)

- Where official correspondence will be received

Estonia’s system is fast, but it assumes clarity. The more precise your inputs, the smoother the process.

Key decisions before Estonia company incorporation

Does Estonia company incorporation mean profits are never taxed?

No, and this misunderstanding causes real problems.

Estonia company incorporation does not eliminate taxation. Instead, it changes when taxation happens. Corporate profits are generally taxed when they are taken out of the company, not while they remain inside it.

This model works well for:

- Businesses reinvesting profits

- Companies planning long-term growth

- Structures where cash is reused rather than extracted

However, salaries, benefits, and distributions must still be handled correctly and reported accurately.

What happens after Estonia company incorporation is completed?

Registration is only the starting point. After Estonia company incorporation, the company enters its operational phase.

Ongoing responsibilities typically include:

- Keeping proper accounting records

- Filing an annual report

- Monitoring VAT obligations if applicable

- Maintaining correct documentation for payments and expenses

At Silva Hunt, an Estonia-based accountancy and tax advisory firm, we often see that issues arise not during incorporation, but months later when reporting deadlines approach without preparation.

For entrepreneurs who want guidance beyond registration, Business setup in Estonia can be simplified with professional support that covers incorporation, accounting, and ongoing compliance from day one.

Ongoing obligations after Estonia company incorporation

What Estonia company incorporation does NOT do for you

To set realistic expectations, it’s important to be clear.

Estonia company incorporation does not:

- Automatically make you an Estonian tax resident

- Replace tax obligations in your home country

- Guarantee banking or payment provider approval

- Remove the need for professional advice

Estonia provides infrastructure and legal clarity – outcomes still depend on how the company is structured and managed.

Why entrepreneurs still choose Estonia company incorporation

Despite these limits, Estonia company incorporation remains popular because it offers something rare: clarity.

Founders value:

- Transparent rules that don’t change unexpectedly

- Digital systems that reduce manual administration

- EU credibility without physical relocation

- Scalability for international growth

For many businesses, this combination outweighs the effort required to stay compliant.

If you are not familiar with the digital access required to manage an Estonian company remotely, please check our e-Residency page for a clear overview of how it works in practice.

Final thoughts

Estonia company incorporation is not a shortcut, loophole, or “tax trick.” It is a structured, digital way to establish an EU company – best suited to entrepreneurs who value predictability and are willing to manage compliance properly.

When expectations are realistic and planning is done upfront, Estonia can be a highly effective jurisdiction for international business.

Schedule a call

Schedule a call

Send a message

Send a message